Table of contents

It’s a common misconception that you need a lot of money to start investing. This might have been true a few years ago when the minimum lot sizes for stocks and high brokerage fees made it impractical to invest just a few hundred dollars.

Today, there are a variety of options available for investors on a budget. Most robo-advisors like Syfe or Stashaway don’t require any minimum investment to get started. Regular savings plans on the market let you start investing from just $50 a month.

For most investors, Singapore stocks are a good way to get acquainted with the market. The Singapore Exchange (SGX) offers more than 700 securities to choose from. It may not be as exciting as the US market, but we think it is still a good training ground for beginner investors.

The Singapore market has its merits

SGX is home to many mature, reputable companies like DBS, Singtel, ST Engineering etc. These companies are well-managed and typically pay decent dividends. From this perspective, the Singapore market is a mostly safe and dependable investment option, especially for investors who may want to start off with a dividend investing strategy.

Over the long-term, your monthly investments get compounded and eventually grow into a comfortable pot of money that can provide you with passive income from your dividends.

This is a strategy The Frugal Fox is building towards as well. Right now, almost one-third of our portfolio is held in dividend paying Singapore stocks, which we’ll share more about in other posts.

Once you learn the ropes and gain confidence, you can then expand to other markets for growth and geographical diversification. Ready to jump in? We’ve narrowed down the three most popular investing options in Singapore that you can get started with from as little as $50.

#1: Singapore REITs

REITs are a popular investment for Singaporeans looking to earn passive income from real estate. The Frugal Fox is particularly partial to REITs because they provide relatively high dividend yields while offering the potential for long-term price appreciation.

Most of us are familiar with retail REITs like CapitaLand Integrated Commercial Trust (CICT) or Frasers Centrepoint Trust (FCT). Malls like Tampines Mall and Junction 8 fall under the portfolio of CICT while the always crowded Waterway Point falls under FCT.

Other than retail REITs, there are 5 other types of REITs you can invest in:

- Commercial / Office REITs (e.g. Suntec REIT)

- Industrial REITS (e.g. Mapletree Industrial REIT)

- Hospitality REITS (e.g. Ascott Residence Trust)

- Healthcare REITs (e.g. Parkway Life REIT)

- Data centre REITs (e.g. Keppel DC REIT)

What REITs should you invest in?

There are currently over 40 REITs listed on the SGX. For beginner investors, choosing which REIT to invest in can be quite time-consuming and involve a bit of research. If you’d rather watch Netflix than read annual reports, one easy way is to just invest in all the top Singapore REITs.

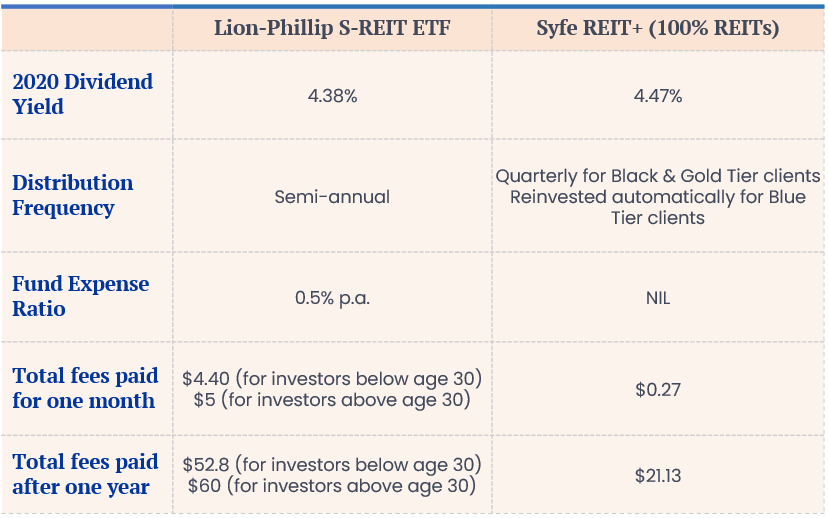

You can do so via an ETF like the Lion-Phillip S-REIT ETF, or a robo advisor like Syfe REIT+ portfolio. With both options, you gain exposure to a diversified selection of REITs with just one investment.

If you’re planning to invest a small sum every month, The Frugal Fox thinks Syfe REIT+ is the most cost effective option. While their top 3 holdings are almost the same, Syfe REIT+ slightly outperforms the Lion-Phillip S-REIT ETF in returns.

Syfe REIT+ highlights

Syfe REIT+ is a REIT portfolio offered by robo advisor Syfe. There are two portfolio options you can choose – a 100% REIT portfolio, or a mix of REITs and Singapore bonds (in a 50-50 allocation).

We selected the 100% REIT option because our risk appetite is higher and we prefer having as much REIT exposure as possible.

Within REIT+, there are 19 REITs with CICT being the top holding. The portfolio tracks the SGX’s iEdge S-REIT Leaders Index, an index which measures the performance of the largest REITs in Singapore. What this means is that REIT+ will include most of the same REITs found on the iEdge S-REIT Leaders Index, and the returns generated by REIT+ will be mostly similar to the index returns.

Syfe REIT+ 2020 dividend yield

In terms of dividends, Syfe states that in 2019, dividend yield was 5.12%. The 2020 dividend yield figure has not been updated on their website yet, but The Frugal Fox wrote in to ask.

- For the 100% REIT portfolio, the dividend yield in 2020 was 4.47%.

- For the REITs and bonds portfolio, it was 3.25%. (This checks out because you’d expect bonds to have a lower yield than REITs.)

No ETF expense ratio with Syfe REIT+

What we also like about REIT+ is that you don’t pay an additional fund expense ratio unlike with a REIT ETF.

REIT+ also has no brokerage fees and no minimum investment amount. The management fees start from 0.65% per annum, going down to 0.4% if you invest $100k or more.

Another advantage over a REIT ETF is that Syfe REIT+ automatically reinvests your dividends for you. According to the CEO in one interview, this has the effect of boosting your total portfolio return by extra 0.5%.

With REIT+, you can also set up a recurring transfer from your bank to the portfolio to create your own automated RSP. If you want to stop it, just delete the recurring transfer from your bank.

Overall, The Frugal Fox thinks it’s a good entry point to REIT investing for new investors. You can set up a Syfe REIT+ portfolio in 5 minutes using MyInfo, and proceed to invest right away!

Note: If you’re a new Syfe customer, sign up using our referral code SRP732ACX to get a $10 bonus when you deposit $500 or more in Syfe REIT+. T&Cs here.

#2: Singapore Blue-Chips

Blue-chip stocks are your stocks like DBS, Singtel, CapitaLand and ST Engineering. They tend to be large, financially sound companies that are often stalwarts of their industries.

Many investors like investing in blue-chip companies because they are familiar and dependable. What’s more, most blue-chips in Singapore tend to offer decent long-term growth prospects and stable dividend yield.

Yet, you should not assume that all blue-chip stocks are automatically good. Commodity trader Noble Group was a blue-chip that ended up being suspended from the SGX after inflating the investment value of its associated companies in Australia.

You still need to do your own research and due diligence before investing in blue-chip stocks. If this sounds like a chore, you can invest in all the current blue-chip stocks on the SGX through the STI ETF.

What’s STI ETF?

Let’s break it down. The STI or Straits Times Index tracks the performance of the top 30 companies listed on SGX. You can think of it as a market barometer for Singapore.

The component companies represent the different industries and sectors that make up Singapore’s economy. You’ll find familiar names like DBS, Singtel and CapitaLand amongst the 30 STI component stocks.

As for ETF (exchange traded fund), it sounds complicated but the idea behind it is simple – owning a big basket of stocks and paying very little for it.

So a STI ETF (such as the SPDR Straits Times Index ETF) is simply a fund that seeks to replicate the performance of the STI. Instead of having to buy all 30 STI stocks, you only need to invest in one STI ETF to gain exposure to the entire Singapore market.

Remember the part about paying very little for it? The current share price of the SPDR Straits Times Index ETF is only $3.05. DBS stock is trading at $26.45 at this time of writing. Buying all 30 component STI stocks is clearly going to be more expensive.

Why STI is still worth investing in

Although some people think the STI has little growth potential compared to US stocks, we think the STI ETF is still a good pick for Singaporeans looking to start their investing journey.

- Most of the companies in the STI pay dividends. These dividends are paid out semi-annually by the SDPR STI ETF. For 2020, the dividend yield was 3.92%. This is attractive, considering that bank interest rates are at all-time lows now.

- The stock price has not yet recovered to pre-COVID levels but it has been rising over the past months. By investing a small sum a month in the STI ETF, you’re accumulating shares at a relatively lower price. We see long-term potential for the stock price to continue rising, as Singapore enters Phase 3 and mass vaccinations begin.

How to invest in the STI

Our recommendation is the FSMOne Regular Savings Plan. The RSP as it is known, is an investment plan that lets you invest a small amount of money into a particular investment product every month.

You can get started with just $50 a month and invest in either the SPDR STI ETF or the Nikko AM Singapore STI ETF as part of your RSP.

FSMOne fees are also lower than other RSP offerings. If you invest $300 a month, you only need to pay $1.07 in fees each month (including GST). If you go with DBS Invest Saver, you’ll be paying $2.61 in monthly fees.

If you prefer to invest a small amount every month into individual blue chip stocks instead, OCBC’s Blue Chip Investment Plan (BCIP) is our recommendation. The BCIP lets you choose from 15 blue-chips such as CapitaLand Integrated Commercial Trust (CICT), DBS and Keppel (you can view the full list here).

#3: Singapore bonds

If you’re risk-averse but still want to get higher returns than the sub 1% offered by your bank account, you can consider bonds.

The safest options would be your Singapore Savings Bonds (SSB), but do note that the returns offered are no longer as attractive due to the current low interest rate environment. If you buy a SSB now and hold it to maturity for 10 years, your effective interest rate will only be 0.89% a year.

If you only hold it for two years, you’ll earn 0.32% each year. In other words, if you invest $1,000 in this current SSB, your total interest after two years will be $32.

Here’s a super handy guide from Seedly that illustrates this.

Of course, the rates are still better than the base interest rate of 0.05% per year on bank savings, so if you’re interested, a minimum investment of $500 is all you need to invest in a SSB.

How to invest in the ABF Singapore Bond Index Fund

If you’re looking for slightly higher returns than the SSB (and also willing to take slightly higher risk), you can consider investing in the ABF Singapore Bond Index Fund.

This is a bond ETF that lets you invest in predominantly Singapore government bonds and government-linked entities like LTA, HDB, and Temasek Holdings. These are very safe and dependable entities, so there’s very little worry that they will default. Simply put, you’re almost guaranteed to get your principal plus interest payments if you hold the bond to maturity.

The ABF Singapore Bond Index Fund is one of the more popular ETFs in Singapore. You can invest in them through a RSP with FSMOne as well. The minimum to get started is $50, same as with the STI ETF.

Conclusion

If your 2021 money resolution is to finally start investing, the STI ETF, Syfe REIT+ and ABF Singapore Bond Index Fund are all solid options for investors looking to drip money into the market.

You don’t even need to open a brokerage account to get started if you choose FSMOne RSP or use Syfe’s robo advisor platform. These two options also allow you to start investing with no or a very low minimum amount so you can grow your wealth deposit by deposit.

If you’re keen to use these platforms, use our referral code for a bonus!

Syfe: If you’re a new customer, enjoy 6 months of free investing when you use our referral code SRP732ACX

You will get SGD $30,000 managed FREE for 6 months. This works out to $75 saved in fees if you invest $30,000, so don’t forget to use it if you’re signing up.

Disclaimer: The information contained herein is the writer’s personal opinion on his blog and does not constitute investment advice. Please do your own due diligence before making any decisions.